The quick ratio is considered a more conservative measure of a company’s ability to meet its short-term obligations. For example, the quick ratio is another financial metric that measures a company’s ability to meet its short-term obligations. Still, it only includes assets that can be quickly converted to cash, such as cash and accounts receivable.

Everything You Need To Master Financial Modeling

For example, a current ratio of 4 means the company could technically pay off its current liabilities four times over. Generally speaking, having a ratio between 1 and 3 is ideal, but certain industries or business models may operate perfectly fine with lower ratios. Increasing sales and revenue can also improve a company’s current ratio. By generating more revenue, a company can increase its cash reserves and accelerate accounts receivable collections, improving its ability to meet short-term obligations. The ideal ratio will depend on a company’s specific industry and financial situation. Investors and stakeholders should review ratios and other financial metrics to comprehensively understand a company’s financial health.

Example 1: Company A

- Such purchases are done annually, depending on availability, and are consumed throughout the year.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations.

- Some industries, such as retail, may have higher current ratios due to their high inventory levels.

Learn the skills you need for a career in finance with Forage’s free accounting virtual experience programs. This can be achieved through better forecasting and demand planning, more efficient production processes, or just-in-time inventory management. To give you an idea of sector ratios, we have picked up the US automobile sector. Finally, if stock picking is not for you, you could try investing in ETFs or in futures markets.

Economic Conditions – How Does the Industry in Which a Company Operates Affect Its Current Ratio?

The current ratio provides a general indication of a company’s ability to meet its short-term obligations, while the quick ratio provides a more conservative measure of this ability. The current ratio includes all current assets, while the quick ratio only includes the most liquid current assets, such as cash and accounts approve and authorize an expense claim in xero receivable. Economic conditions can impact a company’s liquidity and, therefore, its current ratio. For example, a recession may lead to lower sales and slower collections, impacting a company’s ability to meet its short-term obligations. Analyzing a company’s cash flow is crucial when evaluating its liquidity.

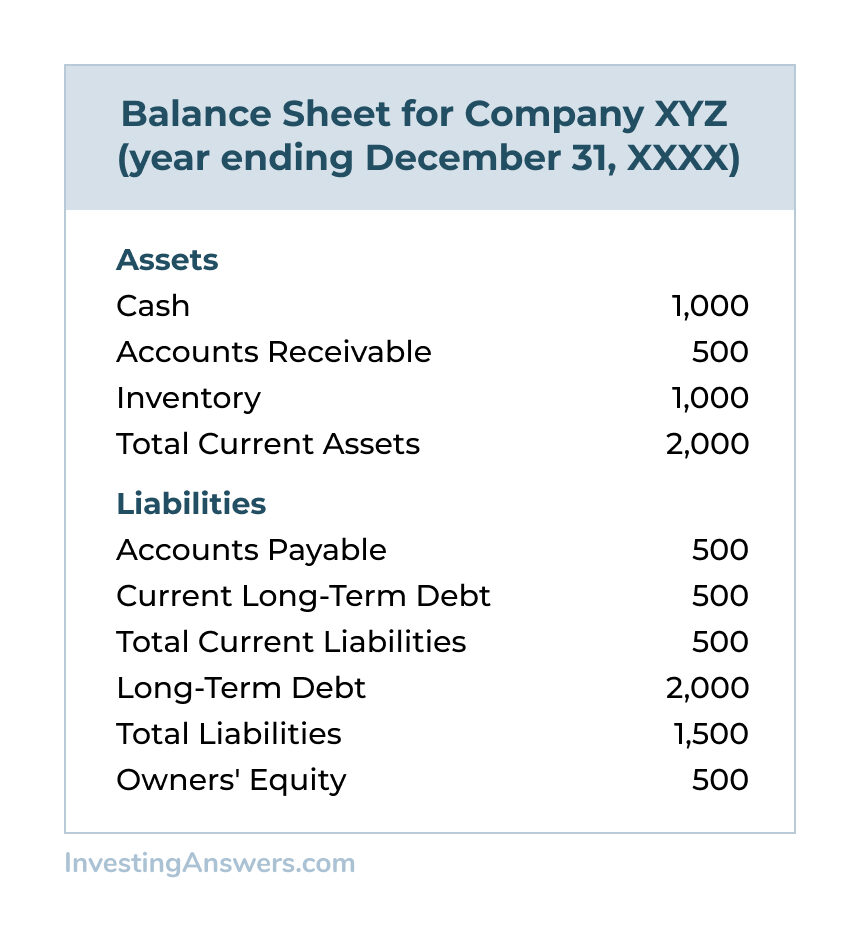

This can lead to missed opportunities for growth and potential financial difficulties down the line. For example, companies in industries that require significant inventory may have a lower quick ratio but still have a good current ratio. We’ll delve into common reasons for a decrease in a company’s current ratio, ways to improve it, and common mistakes companies make when analyzing their current ratio. The current ratio is calculated as the current assets of Colgate divided by the current liability of Colgate. For example, in 2011, Current Assets were $4,402 million, and Current Liability was $3,716 million.

Current Ratio vs. Quick Ratio

By extending payment terms or negotiating discounts for early payment, a company can improve its cash flow and increase its ability to meet short-term obligations. However, balancing this strategy with maintaining good relationships with suppliers is essential. Some industries are seasonal, and the demand for their products or services may vary throughout the year. This can affect a company’s current ratio as it may need to maintain higher inventory levels to meet the demand during peak seasons. A company’s debt levels can impact its liquidity and, therefore, its current ratio. Analyzing a company’s debt levels, including both short-term and long-term, can provide insights into its ability to meet its financial obligations.

In contrast, other industries, such as technology, may have lower current ratios due to their higher levels of cash and investments. This means the company has $2 in current assets for every $1 in current liabilities, indicating that it can pay its short-term debts and obligations. They include accounts payable, short-term loans, taxes payable, accrued expenses, and other debts a company owes to its creditors.

In this case, current liabilities are expressed as 1 and current assets are expressed as whatever proportionate figure they come to. In some cases, companies may attempt to improve their Current Ratio by delaying payments or accelerating the collection of accounts receivable. Analysts must be vigilant for such tactics, which can distort the true financial health of a company.

The current ratio can be useful for judging companies with massive inventory back stock because that will boost their scores. On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation. A high ratio can indicate that the company is not effectively utilizing its assets.