The current ratio can also analyze a company’s financial health over time. Let’s say that Company E had a current ratio of 1.5 last year and a current ratio of 2.0 this year. This suggests that Company E has improved its ability to pay its short-term debts and obligations over the past year. They include cash, accounts receivable, inventory, prepaid expenses, and other assets a company expects to use or sell quickly.

Computating current assets or current liabilities when the ratio number is given

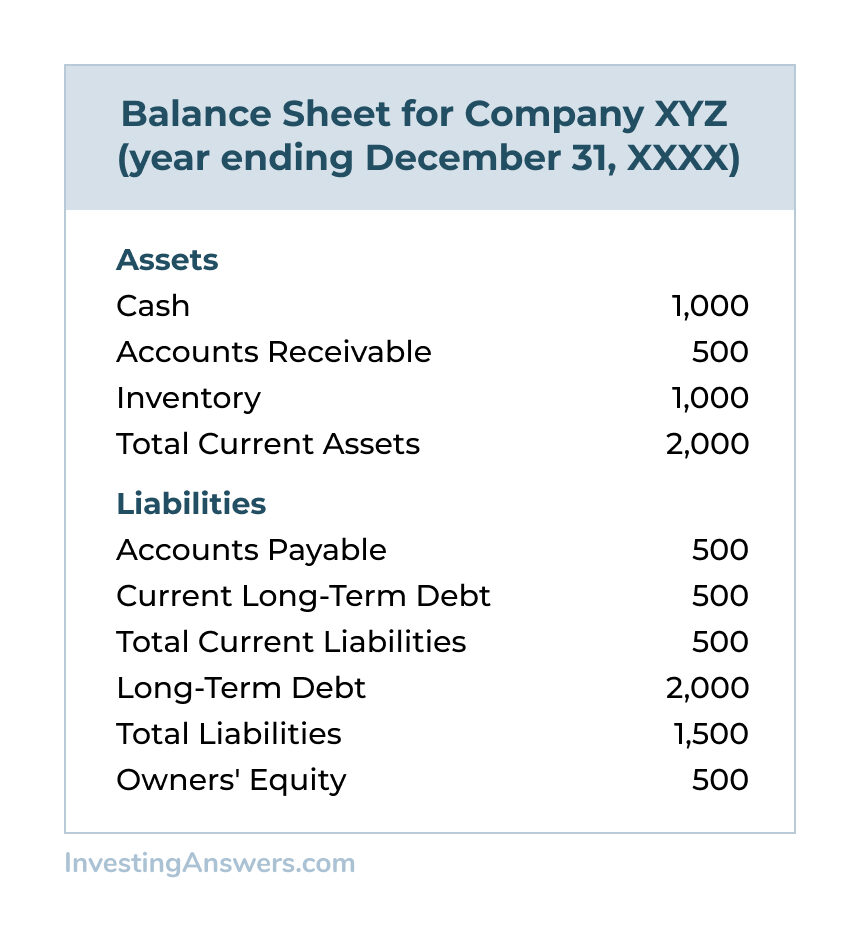

This current ratio guide will cover everything you need about the current ratio, including its definition, formula, and examples. The current ratio is a fundamental financial metric that provides valuable insights into a company’s short-term financial health. Imagine it as a financial health checkup for a business, telling us whether it’s equipped to handle its immediate financial responsibilities or if it might be struggling to meet its short-term obligations. A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. XYZ Inc.’s current ratio is 0.68, which may indicate liquidity problems. Putting the above together, the total current assets and total current liabilities each add up to $125m, so the current ratio is 1.0x as expected.

Current Ratio vs. Quick Ratio

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

What Are Some Common Mistakes Companies Make When Analyzing Their Current Ratio?

- The Current Ratio is a measure of a company’s near-term liquidity position, or more specifically, the short-term obligations coming due within one year.

- As a fundamental financial metric, the current ratio is essential in assessing a company’s short-term financial health.

- As an example, let’s say that a small business owner named Frank is looking to expand and needs to determine his ability to take on more debt.

- However, an examination of the composition of current assets reveals that the total cash and debtors of Company X account for merely one-third of the total current assets.

- The current ratio expressed as a percentage is arrived at by showing the current assets of a company as a percentage of its current liabilities.

Its decreasing value over time may be one of the first signs of the company’s financial troubles (insolvency). The current ratio calculator is a simple tool that allows you to calculate the value of the current ratio, which is used to measure business software explained the liquidity of a company. Note that sometimes, the current ratio is also known as the working capital ratio, so don’t be misled by the different names! The current ratio also sheds light on the overall debt burden of the company.

It encompasses items such as accounts payable, short-term loans, and any other debts requiring repayment in the near future. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. Business owners and the financial team within a company may use the current ratio to get an idea of their business’s financial well-being. Accountants also often use this ratio since accounting deals closely with reporting assets and liabilities on financial statements.

One limitation of the current ratio emerges when using it to compare different companies with one another. Businesses differ substantially among industries; comparing the current ratios of companies across different industries may not lead to productive insight. If all current liabilities of Apple had been immediately due at the end of 2021, the company could have paid all of its bills without leveraging long-term assets. To see how current ratio can change over time, and why a temporarily lower current ratio might not bother investors or analysts, let’s look at the balance sheet for Apple Inc. In this example, the trend for Company B is negative, meaning the current ratio is decreasing over time.

While a high Current Ratio is generally positive, an excessively high ratio may indicate underutilized assets. It’s essential to consider industry norms and the company’s specific circumstances. For example, in some industries, like technology, companies may maintain lower Current Ratios as their assets are less liquid but still maintain financial health. By dividing the current assets balance of the company by the current liabilities balance in the coinciding period, we can determine the current ratio for each year.

A company may have a high current ratio but struggle to meet its short-term obligations if it has negative cash flow. Therefore, analyzing a company’s cash flow statement is essential when evaluating its current ratio. The ideal current ratio can vary by industry, and investors must consider industry-specific variations when evaluating a company’s current ratio. Comparing a company’s current ratio to industry norms can provide valuable insights into its liquidity. The current ratio depends on a company’s accounting policies, which can vary between companies and impact current assets and liabilities calculation.

This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry. The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities. The current ratio is just one of many financial ratios that should be considered when analyzing a company’s financial health. Companies that focus only on the current ratio may miss important information about the company’s long-term financial health. Negotiating better supplier payment terms can also improve a company’s current ratio.